Outsourced Accounting

12/05/2023

12/05/2023

Artificial Intelligence Enters the Tax Realm

Artificial intelligence offers a range of services to leverage for clients. Automation of mundane tasks and generation of insights and personalized

Read More 12/05/2023

12/05/2023

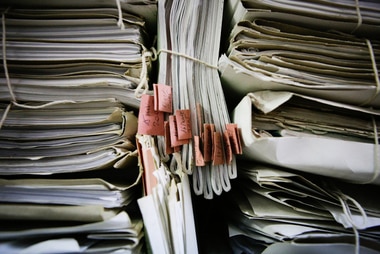

Avoid Incomplete or Disorganized Records

Every employer covered by the Fair Labor Standards Act must keep records for each covered nonexempt worker. There’s no required form, but the

Read More 11/07/2023

11/07/2023

Is This Your Situation: Figuring Out What Expenses You Can Deduct?

“You can deduct that — it’s a business expense” is often casually tossed around, as if it gives business managers carte blanche

Read More 11/07/2023

11/07/2023

More Will Have to E-File in New Year

New rules, issued in early 2023, change a wide range of filing requirements. The goal, according to the IRS, is to increase e-filing without undue

Read More 09/19/2023

09/19/2023

Is This Your Situation: You Need To Get Information From Your Financials

If you don’t understand your financials, you are impeding your ability to grow and prosper. What should you learn about your financial

Read More 09/14/2023

09/14/2023

The Problems with Incomplete and Disorganized Records

An unorganized and inefficient payroll process is a recipe for eventual disaster. If you rely on paper processes, both manual data entries and a

Read More 08/21/2023

08/21/2023

Gifts for Employees: The Thought That Counts

Managers reap benefits from giving presents to their teams: Recipients may feel a morale boost and increased motivation to improve productivity. It

Read More 07/17/2023

07/17/2023

Business Succession in the Post-COVID-19 World

This is not the first or last time you will hear this: COVID-19 changed everything. But it has had a specific impact on business owners who are

Read More 07/17/2023

07/17/2023

What is keeping CFOs up at night?

Today’s CFOs face many concerns, which can be reduced to three overarching issues: The uncertain state of the economy, which is affecting

Read More 06/13/2023

06/13/2023

Watch Out for Fake ERC Plans

ou may be aware of widely circulated promotions — ads on radio and the internet — touting refunds involving Employee Retention Credits. The IRS

Read More