Recent Articles

Check back often as we add new tips for human resource management, accounting, business management, and more.

12/06/2023

12/06/2023

Form I-9 Basics

Form I-9 has been modernized, allowing E-Verify employers to remotely examine I-9 documents. All U.S. employers must complete Form I-9 for everyone

Read More 12/05/2023

12/05/2023

Artificial Intelligence Enters the Tax Realm

Artificial intelligence offers a range of services to leverage for clients. Automation of mundane tasks and generation of insights and personalized

Read More 12/05/2023

12/05/2023

Avoid Incomplete or Disorganized Records

Every employer covered by the Fair Labor Standards Act must keep records for each covered nonexempt worker. There’s no required form, but the

Read More 11/07/2023

11/07/2023

Is This Your Situation: Figuring Out What Expenses You Can Deduct?

“You can deduct that — it’s a business expense” is often casually tossed around, as if it gives business managers carte blanche

Read More 11/07/2023

11/07/2023

More Will Have to E-File in New Year

New rules, issued in early 2023, change a wide range of filing requirements. The goal, according to the IRS, is to increase e-filing without undue

Read More 11/03/2023

11/03/2023

How To Improve and Streamline HR Processes: A Detailed Guide

Human resources serves as the backbone of any organization, responsible for everything from talent acquisition to employee well-being. Efficient HR

Read More 10/20/2023

10/20/2023

What Is Fractional HR? An In-Depth Look

Fractional HR is a modern approach to human capital that allows companies to leverage HR expertise on a part-time basis, providing a solution that is

Read More 10/10/2023

10/10/2023

80 Innovative Employee Engagement Ideas To Boost And Empower Your Team

Employee engagement is more than just a buzzword; it’s a critical factor that can make or break a company’s success. High levels of

Read More 10/10/2023

10/10/2023

How To Create a Raise Policy

In most cases, employees anticipate receiving a raise after working a certain amount of time at your firm — usually, six months to a year. Top

Read More 10/05/2023

10/05/2023

Don’t Just Check the Box on Annual Performance Reviews

Performance management is a holistic approach that assists organizations in accomplishing their goals and objectives by continuously monitoring and

Read More 09/19/2023

09/19/2023

Is This Your Situation: You Need To Get Information From Your Financials

If you don’t understand your financials, you are impeding your ability to grow and prosper. What should you learn about your financial

Read More 09/14/2023

09/14/2023

The Problems with Incomplete and Disorganized Records

An unorganized and inefficient payroll process is a recipe for eventual disaster. If you rely on paper processes, both manual data entries and a

Read More 09/11/2023

09/11/2023

Why Your Organization Needs A Dedicated Employee Onboarding Program

In today’s fast-paced business world, every organization is constantly searching for ways to increase efficiency and productivity. One of the

Read More 08/22/2023

08/22/2023

Is the Hybrid Work Schedule Here To Stay?

The hybrid experiment has gained traction. By 2023, Gallup research indicated the numbers among U.S. workers had stabilized at about 28% performing

Read More 08/22/2023

08/22/2023

New 1099 Portal Helps with Upcoming Paper Filing Restrictions

The IRS has announced that starting in 2024, it is going to “reduce the 250-return threshold enacted in prior regulations to generally require

Read More 08/21/2023

08/21/2023

Learn The Rules About Disability Discrimination

The Americans with Disabilities Act defends the rights of people with disabilities in the context of employment. Title I of the ADA pertains to

Read More 08/21/2023

08/21/2023

Gifts for Employees: The Thought That Counts

Managers reap benefits from giving presents to their teams: Recipients may feel a morale boost and increased motivation to improve productivity. It

Read More 07/17/2023

07/17/2023

Business Succession in the Post-COVID-19 World

This is not the first or last time you will hear this: COVID-19 changed everything. But it has had a specific impact on business owners who are

Read More 07/17/2023

07/17/2023

What is keeping CFOs up at night?

Today’s CFOs face many concerns, which can be reduced to three overarching issues: The uncertain state of the economy, which is affecting

Read More 07/12/2023

07/12/2023

Why You Should Prioritize Succession Planning

What is succession planning? Succession planning is the process of identifying and developing employees to fill key leadership positions within a

Read More 06/29/2023

06/29/2023

Is Your HR Department Meeting the PCORI Deadline?

The Deadline to Pay PCORI Fees is Monday, July 31, 2023. The Patient-Centered Outcomes Research Institute (PCORI) is an independent, non-profit

Read More 06/20/2023

06/20/2023

Bringing on a New Provider? The Importance of Not Waiting For Credentialing

What is credentialing? In a healthcare setting, physician credentialing is the formal process of verifying the professional records that qualify a

Read More 06/13/2023

06/13/2023

Watch Out for Fake ERC Plans

ou may be aware of widely circulated promotions — ads on radio and the internet — touting refunds involving Employee Retention Credits. The IRS

Read More 06/12/2023

06/12/2023

The IRS Is Pushing Its ID.me Accounts

What is ID.me? ID.me simplifies how individuals prove and share their identities online. The idea is that you’ll have to verify your identity

Read More 06/12/2023

06/12/2023

Hiring Temporary Help at the Office

Approximately 3 million temporary and contract workers are hired each year in the U.S., and managers have long relied on temps to keep their

Read More 06/08/2023

06/08/2023

Cannabis in the Workplace – How to Manage Maryland’s New Cannabis Laws

Cannabis in the Workplace – How to Manage Maryland’s New Cannabis Laws Beginning on July 1, 2023, Maryland will legalize the recreational

Read More 05/15/2023

05/15/2023

Why It’s Important to Prioritize Psychological Safety in the Workplace

Psychological safety is the belief that you can share your thoughts, opinions, mistakes, and ideas without fear of negative consequences. It is a

Read More 05/04/2023

05/04/2023

401(k) Plan Self-Audit: Do Not Overlook These 6 Areas

Under IRS and Department of Labor rules, employers whose 401(k) plans have over 120 eligible participants on the first day of the plan year must hire

Read More 05/02/2023

05/02/2023

How and When To File Prescription Drug Data Collection (RxDC) Data

Section 204 of the Consolidated Appropriations Act, 2021 requires insurance companies and employer-based health plans to report on their

Read More 04/26/2023

04/26/2023

COVID19 PHE Ending May 11th 2023: Helpful Tips for Medical Practices to Manage the Transition

As HHS Secretary Xavier Becerra announced in the letter to U.S. Governors, the COVID-19 PHE expired at the end of May 11, 2023. Department of Health

Read More 04/24/2023

04/24/2023

Covid National Emergency Ending May 11th: What HR Compliance Needs To Change and How Can An HR Consulting Solution Help

On Jan. 30, 2023, the Biden Administration announced the COVID-19 national emergency and public health emergency declarations were ending on May 11,

Read More 03/30/2023

03/30/2023

Payroll Tax Rates and Contribution Limits for 2023

Below are federal payroll tax rates and benefits contribution limits for 2023. Social Security tax In 2023, the Social Security tax rate

Read More 03/29/2023

03/29/2023

How to Organize a Retirement Party

Whether you are planning a retirement party for a coworker, a departing boss or even yourself, the most important rule is that it should be an

Read More 03/29/2023

03/29/2023

HUBZone Program: Still Available, Changes Coming

According to the SBA, the HUBZone program fuels small business growth in historically underutilized business zones. The idea is to award at least 3%

Read More 03/20/2023

03/20/2023

5 Tips To Successfully Transition to A Manager Role

Moving from an individual contributor to a manager is a common career progression for many professionals. While it is an exciting opportunity, this

Read More 03/14/2023

03/14/2023

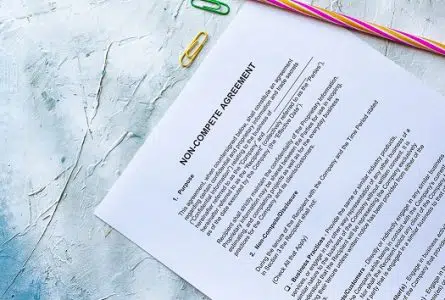

Will My Noncompete Agreement Hold Water?

You may want to require employees to sign noncompete agreements to keep them from working for rival companies. Will these protect the business? The

Read More 03/14/2023

03/14/2023

Know the Rules on Business Travel

Are you working on this year’s tax return or planning for the future? Either way, you should know the rules on business travel tax deductions.

Read More 03/09/2023

03/09/2023

New IRS Portal for Form 1099 Series

The IRS has announced that businesses can now file Form 1099 series information returns using a new online portal, available free from the IRS. Known

Read More 03/09/2023

03/09/2023

Three Ways Employers Can Support Employee Wellness to Drive Retention

Employee wellness has become an increasingly important topic in the workplace, and for good reason. Not only is it important for the health and

Read More 02/20/2023

02/20/2023

Three Considerations When Setting Pay

Your starting salaries should be competitive, fair and aligned with your budget. Many factors come into play when striking this balance, including

Read More 02/20/2023

02/20/2023

Cash Flow Statements: The Key to Business Success

In the complex world of business operations, leaders often find themselves navigating a sea of financial statements and documents. While the income

Read More 02/15/2023

02/15/2023

Business Owners May Face Special Compensation Rules

S corporations allow the business to pass corporate income, losses, deductions and credits through to their shareholders for federal tax purposes.

Read More 02/15/2023

02/15/2023

5 Must Haves for Employee Recognition Programs that Work

According to a recent Gallup survey, it has been shown that approximately “36% of U.S. employees are engaged in their work and

Read More 01/17/2023

01/17/2023

IRS Establishes Mileage Rates for 2023

The IRS has issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,

Read More 01/17/2023

01/17/2023

New Law Ushers in Major Retirement Changes

There’s been buzz about new retirement plan provisions for weeks, and now they’re final, bringing about changes to various federal rules

Read More 01/12/2023

01/12/2023

Should You Reimburse Employees For Home Office Expenses?

What challenges have your employees been facing, and how can you offer the solutions they need? Deciding on a home office reimbursement policy or a

Read More 12/20/2022

12/20/2022

Why Do Small Businesses Hire Firms to Provide HR Advisory Services?

The foundation of any good company, whether a big multinational corporation or a small business, is only as strong as the people who work there. From

Read More 12/12/2022

12/12/2022

Top 5 Tips for Hiring Managers

While the landscape for businesses looks a little wobbly lately, with a post-COVID recession looming and an uncertain stock market, one bright spot

Read More 12/07/2022

12/07/2022

Things to Consider Before Hiring an HR Consulting Firm

If you’re like most business owners, you don’t have a lot of time to spare. That’s why it’s important to do your research

Read More 12/05/2022

12/05/2022

How Do Taxes Work With Bonuses?

Bonuses, frequently given at the end of the year, are a popular “thank you” for a job well done, and smart business owners know they can

Read More 12/05/2022

12/05/2022

Staying Current on Labor Rules

Hiring staff? Good for you! It means your business is thriving. Now is the time to get up to speed or reacquaint yourself with any labor laws

Read More 12/02/2022

12/02/2022

HR Compliance Audit – What to Know, Where to Start

If you’re responsible for human resources in your company, then you know that staying compliant with state and federal laws is a never-ending

Read More 11/15/2022

11/15/2022

Understanding the Maryland Saves Program: A Small Business Owner’s Guide

Table of Contents: Introduction The Maryland Saves Program: An Overview Why Choose the Maryland Saves Retirement Program? Who Is Eligible for the

Read More 11/01/2022

11/01/2022

3 Signs You Have Outgrown Your HR Software Solution

HR and payroll software is pivotal to the success and overall flow of workforce management. At the very least, the HR and payroll solution that you

Read More 11/01/2022

11/01/2022

How HR Should Handle Employee Leave of Absence Requests

During the height of the COVID-19 pandemic, a more flexible workplace was established that included new boundaries for paid and unpaid leave.

Read More 11/01/2022

11/01/2022

What To Know About Fringe Benefits and Taxes

You can generally deduct the amount you pay your employees for the services they perform. The pay may be in cash, property or services. It may

Read More 11/01/2022

11/01/2022

Are You Worried About Inflation?

When inflation is at play, the decline of the value of money and the incline in prices is a combination that impacts everyone. Not even business

Read More 10/07/2022

10/07/2022

Top 8 Reasons to Use Outsourced Accounting Services

Outsourced accounting services are not the right fit for everybody, but it might be a perfect fit for you. Perhaps you don’t have the time or

Read More 09/27/2022

09/27/2022

Tips for Managers: How to Discuss Pay With Your Employees

During the normal course of business, managers are typically required to have conversations with their employees regarding compensation. These

Read More 09/27/2022

09/27/2022

Employee Retention Credit: Over but Not Done

The federal government’s Employee Retention Credit proved to be a lifeline for many businesses and their employees. The eligibility rules were

Read More 09/26/2022

09/26/2022

Are Your Employees Quiet Quitting? What Employers Need To Know

CBS News says, “There’s a new term for clocking in and doing the bare minimum at work: ‘quiet quitting.'” This employee

Read More 09/26/2022

09/26/2022

The Affordable Care Act: A Review and Update

As explained on the official government health care site, the law has three goals: Make affordable health insurance available to more people. The

Read More 09/20/2022

09/20/2022

Fall planning? Remember the Maryland Time to Care Act

Fall planning is upon us and we want to make sure in addition to your thoughts around annual business strategies you are including the new Maryland

Read More 09/14/2022

09/14/2022

Outsourced Accounting and Due Diligence

Due diligence is a deep-dive investigation relating to compliance. It can be an essential function to help you understand your potential liabilities.

Read More 07/29/2022

07/29/2022

Lease Accounting – Should You Lease or Buy?

When it comes to lease or buy, there are pros and cons to both options. In this post, we will explore the advantages and disadvantages of each choice

Read More 07/11/2022

07/11/2022

For Retro ERC, Use Form 941-X

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, may be your key to getting all the Covid relief your business

Read More 07/11/2022

07/11/2022

What Types of Accounting Services Can You Outsource?

Maintain accurate records; keep track of your company’s finances, bookkeeping, payroll, management accounting, taxes, accounts receivable,

Read More 07/11/2022

07/11/2022

Take a Look at the Alternative Workforce

One of the most fitting descriptions of the alternative workforce comes from Deloitte. In the company’s words, they have said that “the

Read More 07/11/2022

07/11/2022

How To Achieve Excellence in HR Service Delivery

The human resource function is responsible for providing services as well as support to employees during their time working for a company, from

Read More 06/21/2022

06/21/2022

The Benefits of Interim Practice Management

The benefits of interim practice management are many. Hiring the wrong person into a senior leadership position is one of the most damaging and

Read More 06/08/2022

06/08/2022

How To Create a Salary Plan

Don’t use guesswork when figuring out how much to pay your employees. You need a comprehensive, long-term plan to figure out a talent strategy.

Read More 06/06/2022

06/06/2022

Identifying Breadcrumbing Signs and Keeping Candidates Engaged: A Guide to Ethical Recruitment

Competing for talent is not easy, especially in a tight labor market. To snag the most qualified candidates, employers must make a good impression.

Read More 06/06/2022

06/06/2022

The Strategic Role of the CFO

The chief financial officer of a company has always had a seat at the table, but the current business environment combined with changes wrought by

Read More 06/06/2022

06/06/2022

Improve Your Payroll Audits With Automation

Payroll is a core feature of all businesses, and it is very important as it heavily impacts the morale of employees. After all, if employees

Read More 05/09/2022

05/09/2022

Integrated Timekeeping: A Strategy for Preventing Payroll Errors

Under the Fair Labor Standards Act, employers are required to maintain updated records of the hours worked by nonexempt employees. According to the

Read More 05/09/2022

05/09/2022

Flexible Work Is Key to Retention

In a flexible work arrangement, employees typically get to choose their work location and their work arrival and departure times. They may also have

Read More 05/09/2022

05/09/2022

Qualities of a Good Payroll Technology Demo

A product demonstration or demo enables vendors to present the value of their product or service to prospective buyers. So if you’re in the

Read More 04/28/2022

04/28/2022

Maryland Enacts Paid Leave Law – What It Means For You

Last month the Maryland Legislation voted to pass a paid family and medical leave insurance program. Called the Time to Care Act, the new legislation

Read More 03/29/2022

03/29/2022

How To Choose a Financial Wellness Vendor

In a 2020 survey, 44.9% of respondents said they would view their employers in a better light if they provided a financial wellness program, and

Read More 03/29/2022

03/29/2022

Is This Your Situation: You Want a Paperless Payroll

Paperless payroll is a paper-free payroll process that has become hugely popular in recent years. But despite the groundswell of support for

Read More 03/29/2022

03/29/2022

How To Hire In A Tough Labor Market

As a manager, you know how to promote your products. In a tough labor market, it may help you to view your job postings in the same way. Think of

Read More 03/18/2022

03/18/2022

COVID-19 Pandemic and Caregiver Discrimination

Discrimination against a person with caregiving responsibilities may be unlawful under federal employment discrimination laws enforced by the Equal

Read More 02/24/2022

02/24/2022

Four Considerations to Grow Your Small-Business HR Department

The consensus among HR leaders is that once you’ve reached the 20-employee mark, it is definitely time to hire a dedicated HR professional. If your

Read More 02/24/2022

02/24/2022

Exempt vs. Nonexempt: Where the Dividing Line Is

Employers covered by the Fair Labor Standards Act are required to pay nonexempt employees for all hours worked. It sounds simple enough, but many

Read More 02/08/2022

02/08/2022

7 Considerations When Preparing Your Payroll Budget

Most companies spend 20% to 30% of their annual revenue on payroll. The exact amount varies based on the employer’s size, industry, and

Read More 02/08/2022

02/08/2022

Essential HR Checklists for Employee Management, Benefits, and Payroll Processing Compliance

Human resources, employee benefits and payroll processing functions are separate yet intertwined, and checklists are essential to staying on top of

Read More 02/07/2022

02/07/2022

Is This Your Situation: You’re Spending Too Much on Bookkeeping

Wondering what your options are to reduce spending and increase income? Here are some tips: Organizing your finances is the foundation for financial

Read More 02/07/2022

02/07/2022

Is This Your Situation: Feeling Overwhelmed by Payroll

Do you ever wish you didn’t have to go through the hassle of preparing a payroll? Maybe it was simple when you just had one or two employees,

Read More 02/07/2022

02/07/2022

Can You Be Exempt and Nonexempt at the Same Time?

You can allow an employee to work two different jobs for your company. However, under the FLSA, you cannot classify an employee as both exempt and

Read More 02/07/2022

02/07/2022

Unemployment and Tax: Back to Normal

Unemployment income has always been taxable income. Those who apply for unemployment benefits can have federal tax, and any applicable state tax,

Read More 01/17/2022

01/17/2022

Payroll Tax Rates And Contribution Limits For 2022

Below are federal payroll tax rates and benefits contribution limits for 2022. Social Security tax In 2022, the Social Security tax rate

Read More 01/17/2022

01/17/2022

Is 401(K) Auto Enrollment Right For Your Company?

Traditionally, employees have to opt into retirement plans and make their own decisions about contributions. But there’s another possibility:

Read More 01/17/2022

01/17/2022

How To Retain Employees In A Tough Market

Imagine you’re a nursing home manager trying to replace a nurse’s aide. But the resumes aren’t coming in like they usually do. You

Read More 01/17/2022

01/17/2022

IRS Announces Standard Mileage Rates For 2022

The IRS has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,

Read More 01/10/2022

01/10/2022

The HHS Stimulus (PRF) Reporting Period 2 opened – What You Need to Know

Background: In April of 2020, the Department of Health and Human Services created the Provider Relief Fund in response to the rapid and widespread

Read More 12/02/2021

12/02/2021

IRS Announces 2022 Limits for Retirement Plans

The IRS has announced the new retirement plan numbers for 2022. Retirement limits for 401(k) and similar plans are up. The contribution limit for

Read More 12/02/2021

12/02/2021

Can You Clearly Explain Your Health Insurance Plan?

According to a report by the International Foundation of Employee Benefit Plans, just 19 percent of employers say their employees had a “high

Read More 12/02/2021

12/02/2021

7 Ways To Manage the Worker Shortage

Many businesses are struggling with a worker shortage. It is happening across the board: staff shortages at our doctors’ offices, at child care

Read More 12/02/2021

12/02/2021

An FMLA Questionnaire To Keep You Compliant

Employer coverage – Is your business covered by the Family and Medical Leave Act (FMLA)? You must adhere to the FMLA if you employ at least 50

Read More 11/03/2021

11/03/2021

On-Demand Pay: A Growing Payroll Trend

A 2020 report by Ernst & Young says on-demand pay is “the term used to describe a category of financial products that give employees the

Read More 11/03/2021

11/03/2021

What Is the Cost of Employee Vacancies?

How much money is lost when you leave a position vacant? There’s a financial impact to keeping a role open. Efficient, productive firms have

Read More 11/03/2021

11/03/2021

Digital Dexterity: The Goal of a Successful Workplace

The workplace of the future is no longer abstract. It is a reality, but a reality that is different for each business. Every workplace has changed

Read More 11/03/2021

11/03/2021

Taxable and Nontaxable Employee Benefits

As the unemployment rate falls from its 2020 high, employees are switching jobs in record numbers. The new stability in the economy means workers

Read More 10/14/2021

10/14/2021

Protecting Wealth Through the Use of Family Offices

Family offices act as the heart of a family’s operations, doing everything from managing their financial lives to overseeing their investments,

Read More 10/13/2021

10/13/2021

The Whys and Hows of Outsourcing Payroll

In Bloomberg Tax & Accounting’s 2019 Payroll Benchmarks Survey, 69.2% of respondents said they used outside vendors to perform payroll

Read More 10/11/2021

10/11/2021

5 Must-Haves for Any Payroll Solution

Studies show that the vast majority of employers use payroll software, which saves time by automating manual processes and decreasing administrative

Read More 10/11/2021

10/11/2021

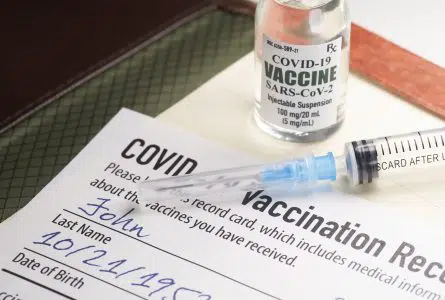

EEOC Provides Updated Guidance on COVID-19 Vaccine Policies

The Equal Employment Opportunity Commission has updated its guidance on workplace COVID-19 vaccine policies. The agency’s original guidance,

Read More 10/11/2021

10/11/2021

HR Compliance Checklist for a Successful Human Resources Audit

When it comes to HR compliance, businesses must take an active approach to ensure they meet all necessary regulations and requirements. Neglecting HR

Read More 09/14/2021

09/14/2021

Sick and Family Leave Reporting Guidance

The Treasury Department and the IRS have issued Notice 2021-53, which provides guidance to employers about using Form W-2 to report the amount

Read More 09/14/2021

09/14/2021

How To Handle Your First Payroll

Regardless of whether your first payroll involves a few employees or many, the goal is to execute payroll in an accurate and compliant manner. Here

Read More 09/14/2021

09/14/2021

Employee Retention Credit: Further Guidance

In COVID Tax Tip 2021-123, the IRS clarifies some of the confusion surrounding the powerful but complex Employee Retention Credit. The IRS is

Read More 09/14/2021

09/14/2021

Vaccine Mandates: The Elephant in the Room

COVID-19 and its variants continue to disrupt the way we live, work and play. The population disagrees on whether to wear masks or be vaccinated, and

Read More 08/12/2021

08/12/2021

Should Employees Get Paid for Orientation & Training?

It is not uncommon for a new hire to pose the question: Do you get paid for orientation? Orientation formally introduces the new hire to the company

Read More 08/12/2021

08/12/2021

Should You Pay an Employee Who Resigns With Two Weeks’ Notice?

An employee who resigns with two weeks’ notice may think they are doing you a favor. But in fact, it can be a payroll headache, especially if

Read More 08/12/2021

08/12/2021

Why Use Time and Attendance Software?

Documentation is key to wage and hour compliance. Simplify time tracking by automatically calculating hours worked as well as vacation time,

Read More 08/12/2021

08/12/2021

What Can a Payroll Service Do for You?

Even if your business has only a few employees, you may be considering outsourcing your payroll processing to a specialist. What can a payroll

Read More 07/23/2021

07/23/2021

Create a Strategy To Bring Back Workers

“Going back to the office” takes on new meaning after more than a year of working from home. Some people are excited to get back to

Read More 07/23/2021

07/23/2021

Health Insurance Plans and Alternatives for Small Businesses

Employer-based health insurance costs have increased modestly since 2012 — between 3% and 5% annually for family coverage, according to a 2020

Read More 07/23/2021

07/23/2021

Executive Order Targets Noncompete Agreements

These days, many employees at companies large and small to sign an agreement when they’re onboarded. It says that they’re not allowed to

Read More 07/23/2021

07/23/2021

What Employers Need to Know About FICA Taxes

The Federal Insurance Contributions Act (FICA) mandates that employers have to withhold, and also match, certain taxes. FICA consists of Social

Read More 06/28/2021

06/28/2021

EEOC Publishes Updated COVID Guidance

As workplaces resume in-person operations, or at least consider doing so, there are many questions about the rules and requirements. However, the

Read More 06/28/2021

06/28/2021

Affordable Care Act Upheld — Again

In a 7-2 decision, the U.S. Supreme Court upheld, again, the Affordable Care Act. Texas and other states had sued to overturn it. The court’s

Read More 06/28/2021

06/28/2021

Retirement Plan Startup Costs Tax Credit

A tax credit for small-employer pension plan startup costs may be awaiting you. You may be able to claim a tax credit of up to $5,000 when you set up

Read More 06/28/2021

06/28/2021

Planning Ahead for Tax Credits and Deductions

Everybody wants to pay as little in taxes as possible. Most people use software or hire an accountant to help them find all the deductions they can

Read More 06/01/2021

06/01/2021

What Is a Money Purchase Pension Plan?

A money purchase pension plan is an employee retirement benefit plan that requires companies to contribute a specific percentage of an

Read More 06/01/2021

06/01/2021

IRS Adjusts HSA Limits for 2022

As it does each year, the IRS has announced changes for health savings accounts, which are associated with high-deductible health plans. The figures

Read More 06/01/2021

06/01/2021

Do You Need an Economic Injury Disaster Loan?

Even before the pandemic, the Small Business Administration offered Economic Injury Disaster Loans for “losses not covered by insurance or

Read More 06/01/2021

06/01/2021

How Do Holidays Affect FMLA Leave?

The Family and Medical Leave Act (FMLA) dictates that employers with 50 or more employees must give eligible employees up to 12 weeks of unpaid,

Read More 04/28/2021

04/28/2021

A Checklist for Navigating Open Enrollment

Before Open Enrollment – Reflect on the previous open enrollment period. Note the successes and failures and formulate a strategy for avoiding

Read More 04/28/2021

04/28/2021

When You Have an HR Department of One

At a minimum, the human resources department handles: Recruiting. Hiring. Compensation. Employee benefits. Training and development. Employee

Read More 04/28/2021

04/28/2021

How Much FMLA Leave Should Part-Time Employees Receive?

To take leave under the Family and Medical Leave Act, an employee must: Work for an employer that has least 50 employees for 20 or more workweeks in

Read More 04/28/2021

04/28/2021

Employers Get Tax Breaks for Vaccination Leave

Small and midsize employers, and certain governmental employers, can claim refundable tax credits that reimburse them for the cost of providing paid

Read More 03/22/2021

03/22/2021

Repaying Deferred Payroll Taxes

IRS Notice 2020-65 allowed employers to defer withholding and payment of the employee’s Social Security taxes. This deferral applied to those with

Read More 03/22/2021

03/22/2021

Rethinking Your Employee Benefits Strategy

In the past, as long as you provided health insurance and retirement benefits, your benefits were considered competitive. Now, the pressure is on

Read More 03/22/2021

03/22/2021

Hiring in a New Era

As you create your company’s hiring plan for a post-pandemic world, you need to adapt to a new reality. To begin with, you will need to

Read More 03/22/2021

03/22/2021

7 Key Aspects of Payroll Compliance

1. Federal wage and hour laws The Fair Labor Standards Act (FLSA) sets federal wage and hour standards, which are administered by the U.S. Department

Read More 03/03/2021

03/03/2021

Employment Records Retention: What Are the Federal Laws?

How long do you have to keep records? There’s no one answer. However, we’ve summarized some of the most common federal laws relevant to

Read More 03/03/2021

03/03/2021

What Will Retaining Talent Look Like in the Post-Pandemic Workplace?

Who could have predicted the disruption and change 2020 brought to the way we work? Now that we are starting to look ahead, past the loss and the

Read More 03/03/2021

03/03/2021

Common Overtime Mistakes To Avoid

There are many ways to run afoul of overtime laws. Below are some of the most common — review them to ensure that you’re always in

Read More 03/03/2021

03/03/2021

Can Employers Mandate Vaccinations?

Can an employer require its employees to get vaccinated against COVID-19? It’s a simple question, but one that does not have an easy answer. In

Read More 02/02/2021

02/02/2021

An Overview of Federal and State Overtime Exemption Laws

On Sept. 24, 2019, the U.S. Department of Labor issued a final rule increasing the salary threshold for executive, administrative and professional

Read More 02/02/2021

02/02/2021

Are Your Employees Cross-Trained?

When employees quit or miss work for some reason, when layoffs become necessary, or even when it’s just a matter of busy season, cross-trained

Read More 02/02/2021

02/02/2021

What Are Predictive Scheduling Laws?

At times, you may want to suddenly change an hourly employee’s work schedule to better suit your business needs. However, several jurisdictions

Read More 02/02/2021

02/02/2021

Employee Retention Tax Credit Gets a Boost

The second relief bill, passed at the end of 2020, contains updates to the employee retention credit, a refundable payroll tax credit. Each option

Read More 01/14/2021

01/14/2021

5 Time Sensitive Projects Medical Practices Can’t Ignore in 2021

Medical practices should prioritize these 5 time-sensitive projects for the first quarter of 2021. Ever-changing government regulations,

Read More 12/08/2020

12/08/2020

UnitedHealthcare Telehealth and Telemedicine Policy Modifications Effective 1/1/2021

In the latest Provider Newsletter, UnitedHealthcare (UHC) revealed their revised telehealth reimbursement policies for 2021. Among the revisions, UHC

Read More 12/02/2020

12/02/2020

IRS Updates Form 941 To Reflect COVID-19 Tax Credits

The IRS has revised Form 941, Employer’s Quarterly Federal Tax Return, to accommodate COVID-19-related employment tax credits granted under the

Read More 12/02/2020

12/02/2020

What the Taxpayer First Act Means for Employers

According to the IRS’ website, the Taxpayer First Act of 2019 “aims to broadly redesign” the IRS by expanding and strengthening

Read More 12/02/2020

12/02/2020

Cash Balance Plans: Defined-Benefit with a Twist

Both individuals and the companies they work for continue to explore new ways to address the finances of retirement. One option is the cash balance

Read More 11/25/2020

11/25/2020

CMS Physician Fee Schedule and RVU Value Changes for 2021 – 7 Areas to Consider

The Centers for Medicare and Medicaid Services (CMS) released its proposed rule for the 2021 Medicare Physician Fee Schedule (PFS) in August of 2021.

Read More 10/07/2020

10/07/2020

Medicare AAPP Recoupment Terms Finalized

A sigh of relief can be heard amongst the medical community last week. Lawmakers granted an extension for providers who had their Medicare payments

Read More 09/18/2020

09/18/2020

Medicare Accelerated Payment Program’s Recoupment Paused for DC and Maryland Providers

Backround The Centers for Medicare and Medicaid’s (CMS) Accelerated Medicare Payment program provided advance payments to a significant number of

Read More 09/08/2020

09/08/2020

New CPT Code 99072 Usage and Coverage

Early this month, the American Medical Association (AMA) published an update to the Current Procedural Terminology (CPT) code set. The update

Read More 04/14/2020

04/14/2020

HHS Stimulus Deposits To Physician Practices

On Friday, April 10th medical practices started to notice large deposits appearing in their business checking accounts labeled “HHS Payment US HHS

Read More